Quantitative Researcher

Job Highlights

- A PhD is highly preferred

- Hires will be given a personal risk allocation

- 3-5 yrs of relevant exp

I am working with a global hedge fund looking to expand their business after stellar performances in 2024. My client are looking for a Quantitative Researcher to join their team in Hong Kong. In this role, you will collaborate with experienced quants to generate alphas and develop systematic trading strategies. Hires will be given a personal risk allocation to manage, providing direct responsibility for PnL generation.

Responsibilities

- Conduct independent quantitative research to identify and develop profitable investment strategies.

- Collaborate with other quants on cutting-edge techniques to generate alphas.

- Implement models using advanced mathematical and statistical tools.

- Manage a personal risk allocation and contribute directly to PnL generation.

- Continuously test and refine strategies, optimizing for risk-adjusted returns.

Requirements

- 3-5 years of relevant experience in buyside quantitative research.

- Strong academic background, preferably with a degree in a technical subject (Mathematics, Statistics, Computer Science, Physics, etc.). A PhD is highly preferred.

- Proven ability to apply quantitative techniques to real-world financial problems.

- Experience with programming languages such as Python, C++, or similar.

- Strong understanding of financial markets, risk management, and portfolio construction.

What They Offer

- A dynamic and inclusive work culture focused on collaboration and continuous learning.

- The opportunity to directly manage risk and make a meaningful impact on the fund’s performance.

- Access to cutting-edge tools, data, and resources to support your research and growth.

- Competitive salary and performance-based incentives.

All applications applied through our system will be delivered directly to the advertiser and privacy of personal data of the applicant will be ensured with security.

Skills

More Information

| Salary | N/A (Search your salary info in  ) ) |

| Job Function | |

| Location |

|

| Work Model |

|

| Industry | |

| Employment Term |

|

| Experience |

|

| Career Level |

|

| Education |

|

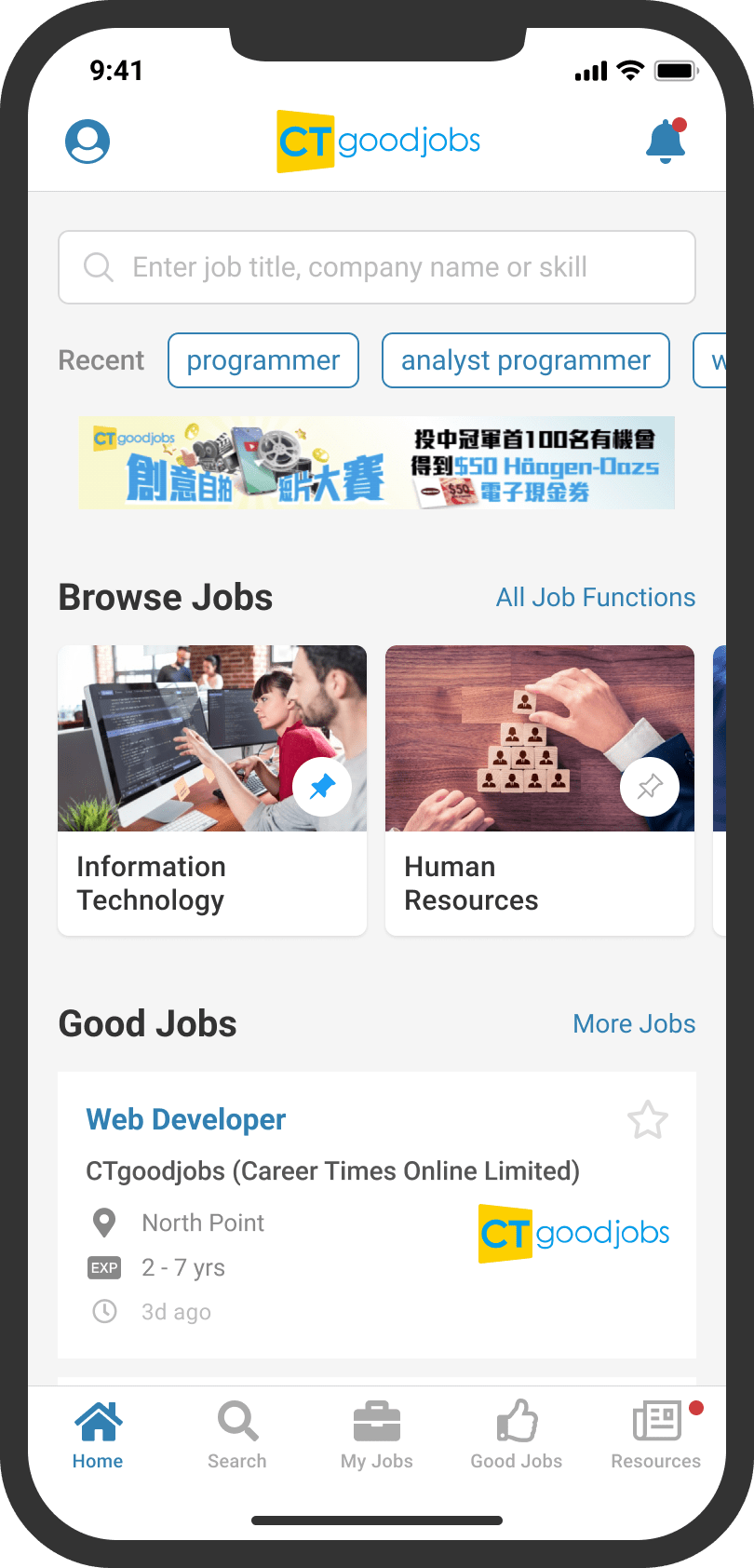

Get lastest jobs, career news and

job invitations on-the-go.

Download the CTgoodjobs app

Stay on website