Real Estate Investment Analyst

Job Highlights

- A Master’s degree or CFA designation is preferred

- Proficiency in Japanese is a plus

- Willingness to travel

Key Responsibilities:

· Prepare comprehensive research, financial analysis, and perform due diligence on potential investment opportunities.

· Prepare detailed investment reports, presentations, and updates.

· Assist in the execution of real estate transactions.

· Develop and maintain financial models for investment analysis.

· Monitor market trend, analyze sector performance, and conduct asset management of invested projects.

· Coordinate with external professional parties, including lawyers, agents, property managers, and tenants.

Qualifications:

· A major in Finance, Economics, Real Estate or Statistics at either the Master’s or Bachelor’s level from leading universities. A Master’s degree or CFA designation is preferred.

· Excellent quantitative and qualitative analytical skills

· 1-2 years’ professional experience in investment or real estate related fields

· Proficiency in preparing financial models and delivering PowerPoint presentations.

· Strong written and oral communication skills in English and Putonghua. Proficiency in Japanese is a plus.

· A strong sense of responsibility and the ability to multitask effectively.

· Familiarity with real estate investment fundamentals, would be beneficial.

· Willingness to travel.

Contact: CV to [via CTgoodjobs Apply Now]

All applications applied through our system will be delivered directly to the advertiser and privacy of personal data of the applicant will be ensured with security.

More Information

| Salary | N/A (Search your salary info in  ) ) |

| Job Function | |

| Location |

|

| Work Model |

|

| Industry | |

| Employment Term |

|

| Experience |

|

| Career Level |

|

| Education |

|

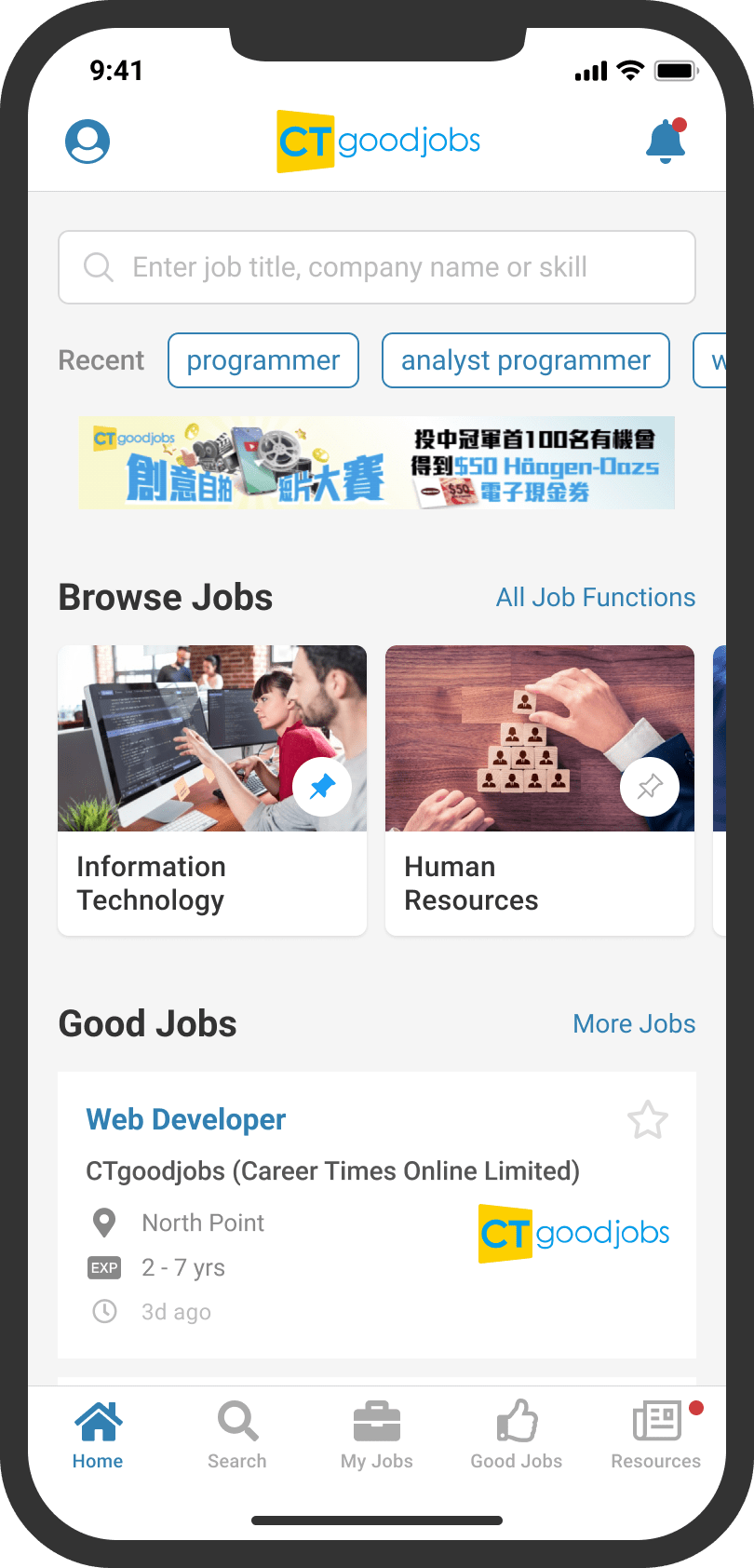

Get lastest jobs, career news and

job invitations on-the-go.

Download the CTgoodjobs app