Anti-Money Laundering Officer

Job Highlights

- Provide advice to COB and lines of business

- At least 3 yrs of exp

- Execute compliance monitoring, reviews

Our Client, a Global Corporate and Investment bank, is seeking a Anti-Money Laundering Officer to join its small team. This role also covers general Regulatory Compliance but the key knowledge is at least 3 years of AML CDD experience within a Corporate or Investment Bank.

Responsibilities

- Investigate and clear AML and Sanction related alerts escalated from first line of defence.

- Review CDD files escalated by Client Onboarding Team (COB)

- Provide advice to COB and lines of business on internal policy and local regulatory requirements on Financial Crime Compliance related topics.

- Execute compliance monitoring, reviews and testing requirements for Financial Crime Compliance (FCC) and non FCC themes

- Assist senior compliance officers in their effort to complete Compliance Risk Assessments including Key Risk Indicator (KRI) assessments that are in line with Global Compliance Themes.

- Assist to compile MI for management reporting in Hong Kong, the region and global.

- Assist senior compliance officers in Financial Crime Compliance or non FCC tasks from time to time such a system roll outs etc.

- Assist the senior compliance officers to prepare/review/coordinate regulatory projects, submissions, enquiries, assessments and deliverables stipulated by the Hong Kong regulators.

- Assist Head of Compliance in providing advice to the business regarding rules and standards, proper codes of conduct and doing the right thing.

- Update Compliance policies, procedures, codes and guidelines on a regular basis to ensure the appropriateness and fit-for-purpose of these standards and to propose amendments as required. Complete gap analysis and assessments with respect to internal policies and standards.

- Conduct relevant training for staff and regular induction training for new staff including rolling out of any Group Compliance e-learning initiatives.

- Perform day-to-day compliance administrative supports including PAD, licensing.

Requirements

- At least 3 years of experience in Financial Crime Compliance within a Corporate or Investment Bank

- Detail-oriented, analytical, articulative and ability to identify potential issues and solutions

- Excellent communication, interpersonal, influencing and negotiating skills

Budget: Up to HKD $48K per month.

We regret to inform you that only shortlisted candidates will be contacted with regards to the opportunity and all candidates must currently be based in Hong Kong.

All applications applied through our system will be delivered directly to the advertiser and privacy of personal data of the applicant will be ensured with security.

Skills

More Information

| Salary | N/A (Search your salary info in  ) ) |

| Job Function | |

| Location |

|

| Work Model |

|

| Industry | |

| Employment Term |

|

| Experience |

|

| Career Level |

|

| Education |

|

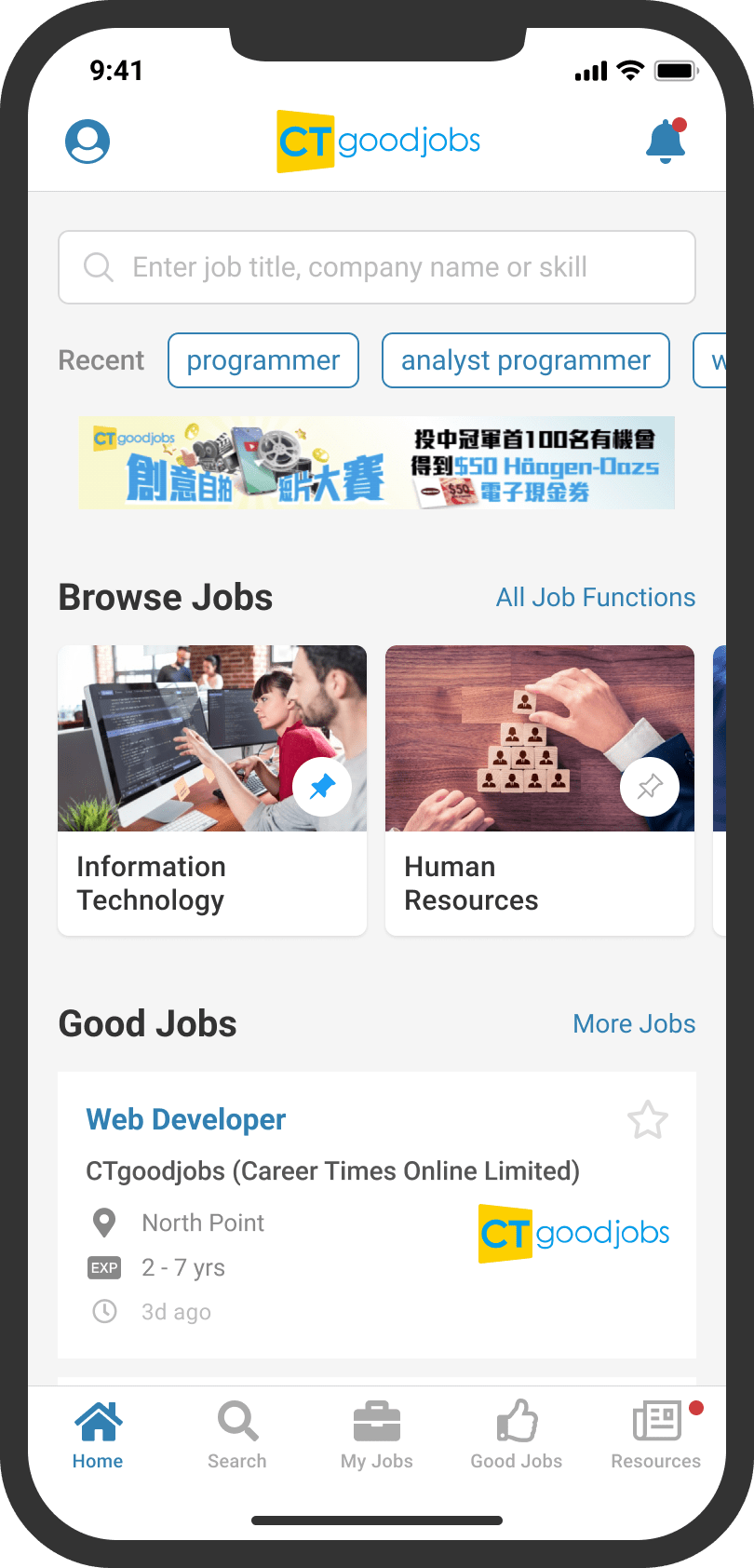

Get lastest jobs, career news and

job invitations on-the-go.

Download the CTgoodjobs app

Stay on website