Investment Analyst, Venture Capital

Job Highlights

- Financial modelling capability

- Proficiency in English and Mandarin

- Originate and lead investments in cooperation

Responsibilities:

- Originate and lead investments in cooperation with capital team as well as collaboration senior management.

- Be responsible for the qualitative and quantitative analysis of various investment opportunities.

- Support senior investment professionals in due diligence procedures, research and financial modelling.

- Prepare materials for senior professionals to use in client meetings, to support the firm's engagement with institutional investors.

- Focus on direct investment in growth-stage technology / blockchain companies. Investment scope also includes U.S, Europe, and Asia.

- Ongoing relationship management with assigned companies and fund managers including monitoring of investments, attendance of AGM, and advisory board meetings.

- Overall operational support with regards to reporting and investor updates.

Requirements:

- 1-3 years of working experience in financial markets with a strong financial literacy and analytical skills.

- Experience in private equity, research or investment banking would be an advantage.

- Excellent organizational, time management and planning skills.

- Strong quantitative background to support data-informed decision making.

- Financial modelling capability.

- Solid, demonstrated oral and written communication skills.

- Proficiency in English and Mandarin.

- Strong computer skills, especially with MS Excel and PowerPoint.

All applications applied through our system will be delivered directly to the advertiser and privacy of personal data of the applicant will be ensured with security.

Skills

More Information

| Salary | N/A (Search your salary info in  ) ) |

| Job Function | |

| Location |

|

| Work Model |

|

| Industry | |

| Employment Term |

|

| Experience |

|

| Education |

|

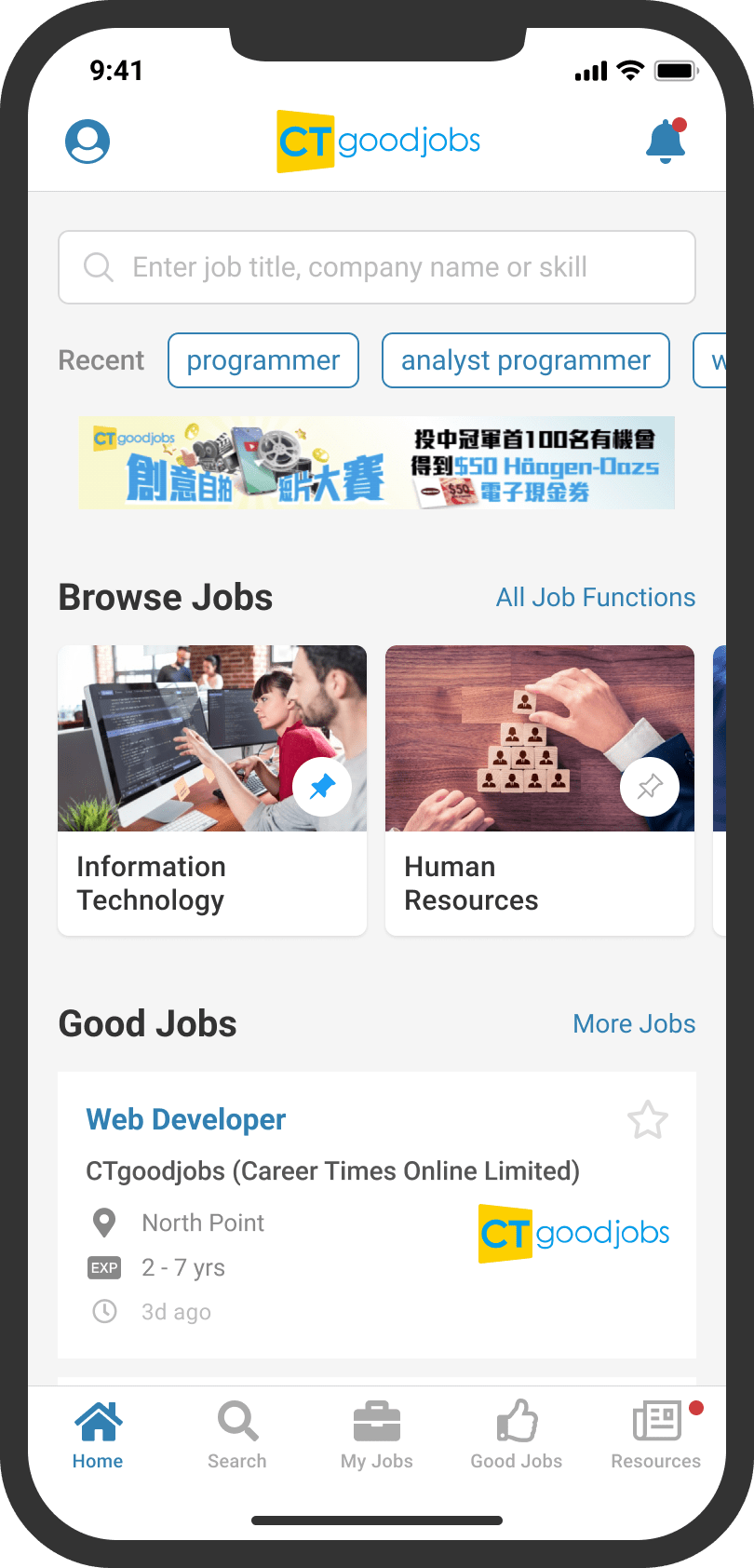

Get lastest jobs, career news and

job invitations on-the-go.

Download the CTgoodjobs app

Stay on website