Management Trainee

1.Training and Development:

Participate in a structured training program to understand company policies, procedures, and culture with a focus on risk management and compliance.

Shadow experienced risk and compliance consultants to gain insights into best practices and industry standards.

2. Operational Support:

Assist in daily operations within the risk management and compliance departments to learn workflow and regulatory requirements.

Support the execution of risk assessments and compliance audits, ensuring alignment with industry regulations.

3. Analysis and Reporting:

Conduct research and analyze data related to risk exposure and compliance issues to support strategic decision-making.

Prepare detailed reports and presentations summarizing findings, recommendations, and compliance status.

4. Team Collaboration:

Collaborate with cross-functional teams, including legal and financial departments, to drive risk management and compliance initiatives.

Participate in team meetings to contribute ideas for enhancing risk management strategies and compliance frameworks.

5. Customer Interaction:

Engage with stakeholders to gather feedback on compliance processes and understand their needs in relation to risk management.

Support client consultations to explain compliance requirements and risk mitigation strategies.

Identify areas for improvement in compliance processes and propose actionable solutions.

6. Leadership Development:

Develop leadership skills through mentorship and participation in workshops focused on risk management and compliance.

Take on small leadership roles in projects to build confidence and experience in guiding teams.

7. Project Management:

Lead specific projects related to risk assessments and compliance initiatives, ensuring timely delivery and adherence to standards.

Manage project resources, timelines, and budgets effectively.

8. Compliance and Quality Assurance:

Ensure adherence to regulatory requirements and company policies in all activities related to risk management.

Participate in quality assurance processes to maintain high compliance standards.

9. Continuous Learning:

Stay updated on industry trends, regulations, and best practices in risk management and compliance through research and training.

Seek feedback and actively pursue opportunities for personal and professional growth in the risk management field.

The programme is open to all degree graduates from all academic disciplines. Do apply to us by clicking this link or send your CV to [via CTgoodjobs Apply Now] , if the following describes you:

- Graduating in 2025 or have less than three years of work experience

- Upright, humble, diligent with stroung committment to high moral values

- Dedicated to risk management and compliance, with a strong interest in the dynamic banking and finance industry

- Effective communicator with excellent interpersonal skills and a team player

- Demonstrates strong analytical and problem-solving abilities, a proactive mindset, and a keen eye for detail.

- Exhibits a strong sense of responsibility, a willingness to learn, and a desire for long-term employment.

Skills

More Information

| Salary | N/A (Search your salary info in  ) ) |

| Job Function | |

| Location |

|

| Work Model |

|

| Industry | |

| Employment Term |

|

| Experience |

|

| Career Level |

|

| Education |

|

| Require to Travel |

|

CT Risk Solutions Limited (CT Risk) was founded in 2007 and is currently an associate member of Private Wealth Management Association as well as institutional member of Treasury Markets Association in Hong Kong. In the aftermath of the financial crisis in 2008, CT Risk has assisted a number of banks in Asia with reengineering their wealth management infrastructure in pursuit of adherence to ever stricter regulatory requirements. The progress has laid down a momentous milestone amid the industry and spurred the growth of wealth management business.

CT Risk has been certified with ISO 9001 quality management system standard with regard to the provision of quantitative risk analysis services together with certified ISO 27001 Information & Data Security in 2021. Meanwhile CT Risk has embarked on its development of “RegTech” that utilizes information technology to enhance regulatory productivity with focus on the digitization of manual reporting, compliance processes and standardization in the context of KYC and product due diligence requirements. To reinforce the quality and versatility of service, CT Risk has set up its own subsidiaries which are located in Taiwan and Singapore to provide ancillary operations and serve as contingency plan to form a strategic alliance in the delivery of mutually beneficial projects.

CT Risk has established a long-standing business relationship with a host of both local and international banks by providing professional advisory services in respect of the up-to-date market practices and regulatory requirements on the areas like review on internal capital adequacy assessment process, policies and procedures on investment/insurance product selling process and suitability assessment, product due diligence, product risk rating, customer risk profiling and professional training.

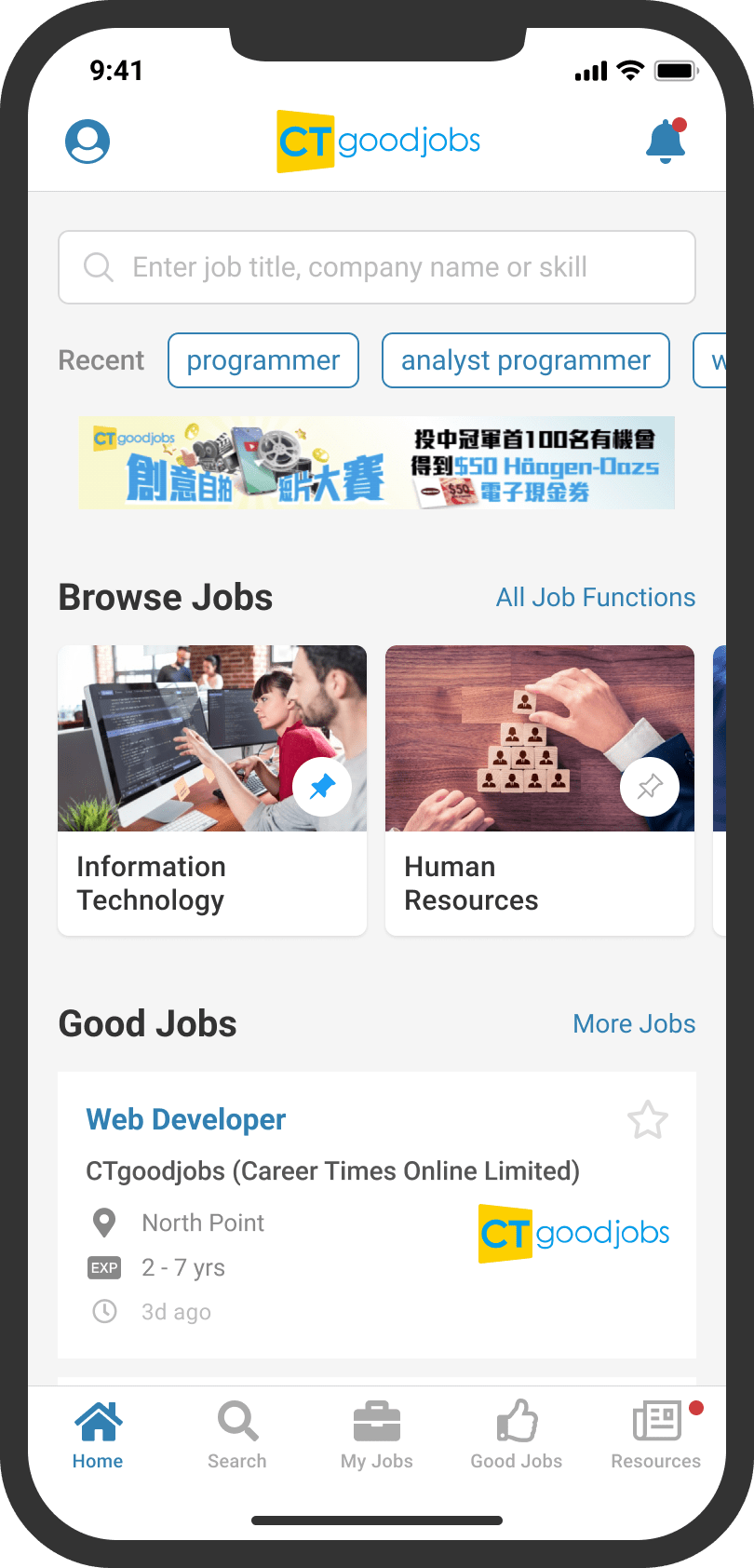

Get lastest jobs, career news and

job invitations on-the-go.

Download the CTgoodjobs app