Equity Analyst- Japanese Speaking

Job Highlights

- Minimum of bachelor’s degree

- Graduate degree or CFA designation preferred

- Produce value-added research that

Our equities research group is seeking a bilingual English -Japanese analyst to cover companies listed in Japan. Performing fundamental analysis within our well-defined research framework, the analyst will write research reports and determine fair values on a select group of stocks. They will also be accountable for pitching investment ideas internally and externally in accordance with Morningstar’s investment methodology. This position is based either in our Hong Kong or Singapore offices.

Responsibilities:

- Produce value-added research that encompasses both the determination of a fair value estimate and a thorough examination of the company’s competitive position.

- Build valuation models on coverage companies primarily utilizing Morningstar’s discounted cash flow based valuation model.

- Be proactive in updating clients via the publication of impactful, value-added research that demonstrates well-thought out opinions and action oriented recommendations backed up by fact and data.

- Develop relationships with coverage companies and industry participants to enhance research and build our brand.

- Reach out to Morningstar’s global research team to share ideas and information so that the team is kept informed of any relevant industry developments and also to form consistent, and complete analysis of the companies in question.

- Be able to communicate well in both English and Japanese with strong English writing skills.

- Possess independence, critical thinking skills, and a passion for fundamental equity investing.

- Work well within a team and be capable of respectfully accepting and providing constructive feedback.

- Make timely decisions under demanding deadlines, sometimes with incomplete information.

- Interest in developing financial modeling skills together with knowledge of business valuation techniques.

- Minimum of bachelor’s degree.

- Graduate degree or CFA designation preferred.

- At least 5 years of experience gained in a research position, with some experience in the sell-side a plus but we will also consider those with industry research experience as long as thought leadership, knowledge of equity markets and an understanding of financial modelling can be demonstrated.

A98_MstarResSingapor Morningstar Research Pte Ltd. (Singapore) Legal Entity

All applications applied through our system will be delivered directly to the advertiser and privacy of personal data of the applicant will be ensured with security.

More Information

| Salary | N/A (Search your salary info in  ) ) |

| Job Function | |

| Location |

|

| Work Model |

|

| Industry | |

| Employment Term |

|

| Experience |

|

| Career Level |

|

| Education |

|

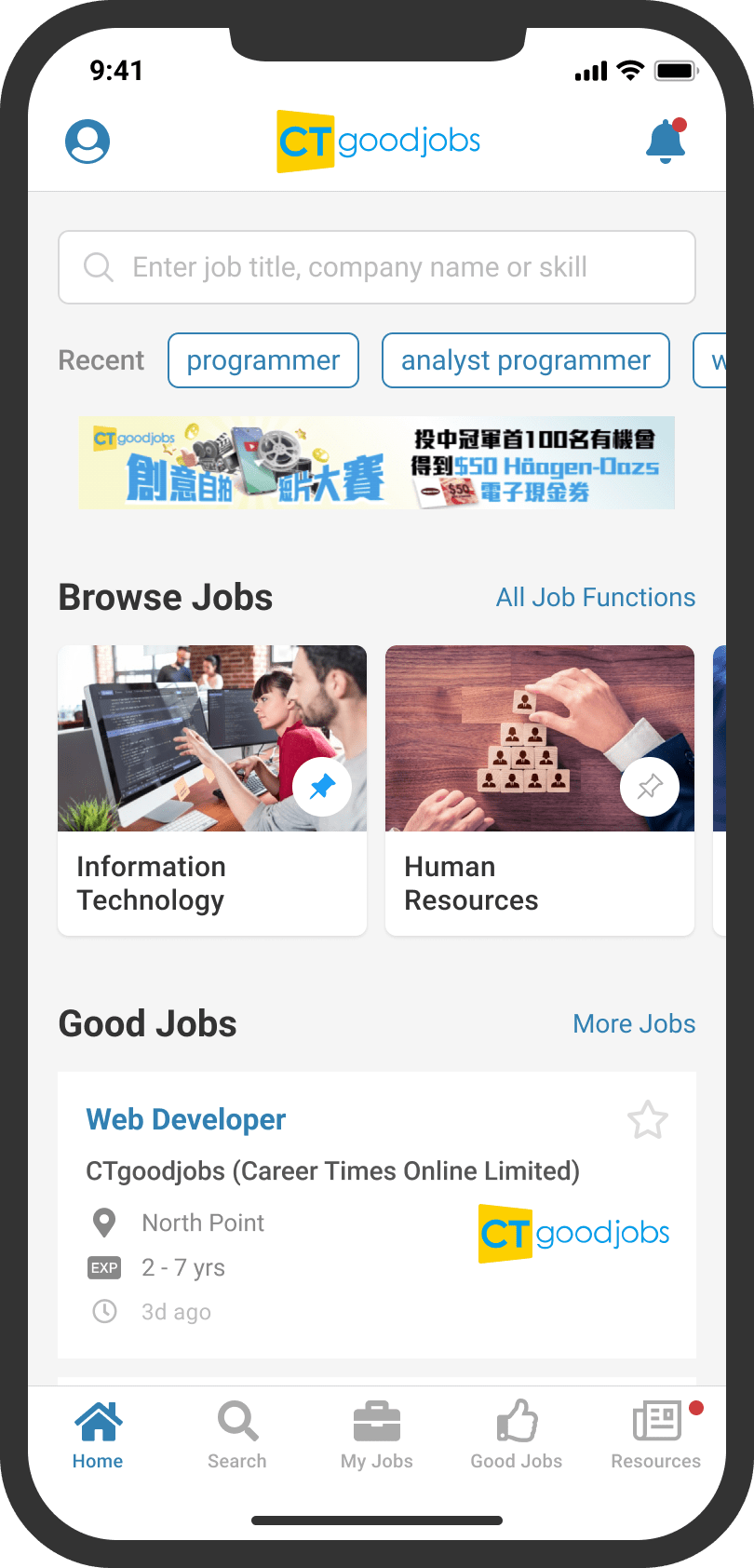

Get lastest jobs, career news and

job invitations on-the-go.

Download the CTgoodjobs app

Stay on website