Senior Manager, Actuarial

Job Description

In this position you will....

Assess, monitor and improve the profitability of the portfolio. Peer review the actuarial reserving process for bolttech HK GI and recommend Management for actions. Lead pricing actions that will yield business growth profitably for new and existing products.

You will be responsible for…

We expect you to be able to demonstrate the following key competencies

Curious

You will require the following qualifications and skills

In this position you will....

Assess, monitor and improve the profitability of the portfolio. Peer review the actuarial reserving process for bolttech HK GI and recommend Management for actions. Lead pricing actions that will yield business growth profitably for new and existing products.

You will be responsible for…

- Conceptualize and plan the pricing roadmap and strategic initiatives for bolttech general insurance business

- Lead the pricing and actuarial governance for for bolttech general insurance products – consumer and commercial lines

- Portfolio analysis of each product line to achieve business plan targets for Loss ratio and combine ratio

- Manage and support the actuarial reserving process for bolttech and conduct peer review of work done by the reserving firm

- Working with multiple stakeholders including tech, ops and claims to automate performance dashboards

- Collaborate with underwriting teams to assess the pricing benchmarks and keep on revising the same

- Conduct stress test of new products or programs launched to ensure appropriate forecasting on a periodic basis

We expect you to be able to demonstrate the following key competencies

Curious

- Actively seeks to learn from others and is inquisitive in order to increase knowledge and competence. Expands understanding of team’s key activities for improved collaboration.

- Motivated and self-directed, identifying opportunities to grow and acquire new knowledge from a range of sources. Has a sound comprehension of relevant multi-discipline areas of expertise.

- Proactive in identifying what needs to be done, and taking action, before being asked, or before the situation escalates

- Takes accountability and self-motivated to deliver results even in situations which are not straight-forward.

- Develops collaborative and dynamic working relationships to achieve the best possible outcomes

- Resolves disputes using a range of tactics to prioritize positive outcomes

- Concise in communicating and references relevant information tailored to the audience to support points

- Shares accurate, timely information with the right people in an appropriate format for the audience

You will require the following qualifications and skills

- Bachelor’s degree in any discipline or Actuarial Science

- Minimum 10 years of experience in General Insurance (direct insurer/reinsurer) in Asia.

- Exposure to underwriting/ pricing and profitability control is needed

- Experience in reinsurance placements in coordination with reinsurers and insurers will be a plus

- Extensive knowledge of products like motor, medical, property, employee compensation and Personal accident will be useful

- Excellent data analytic skills preferred for portfolio management and profit and loss analysis

All applications applied through our system will be delivered directly to the advertiser and privacy of personal data of the applicant will be ensured with security.

More Information

| Salary | N/A (Search your salary info in  ) ) |

| Job Function | |

| Location |

|

| Work Model |

|

| Industry | |

| Employment Term |

|

| Experience |

|

| Career Level |

|

| Education |

|

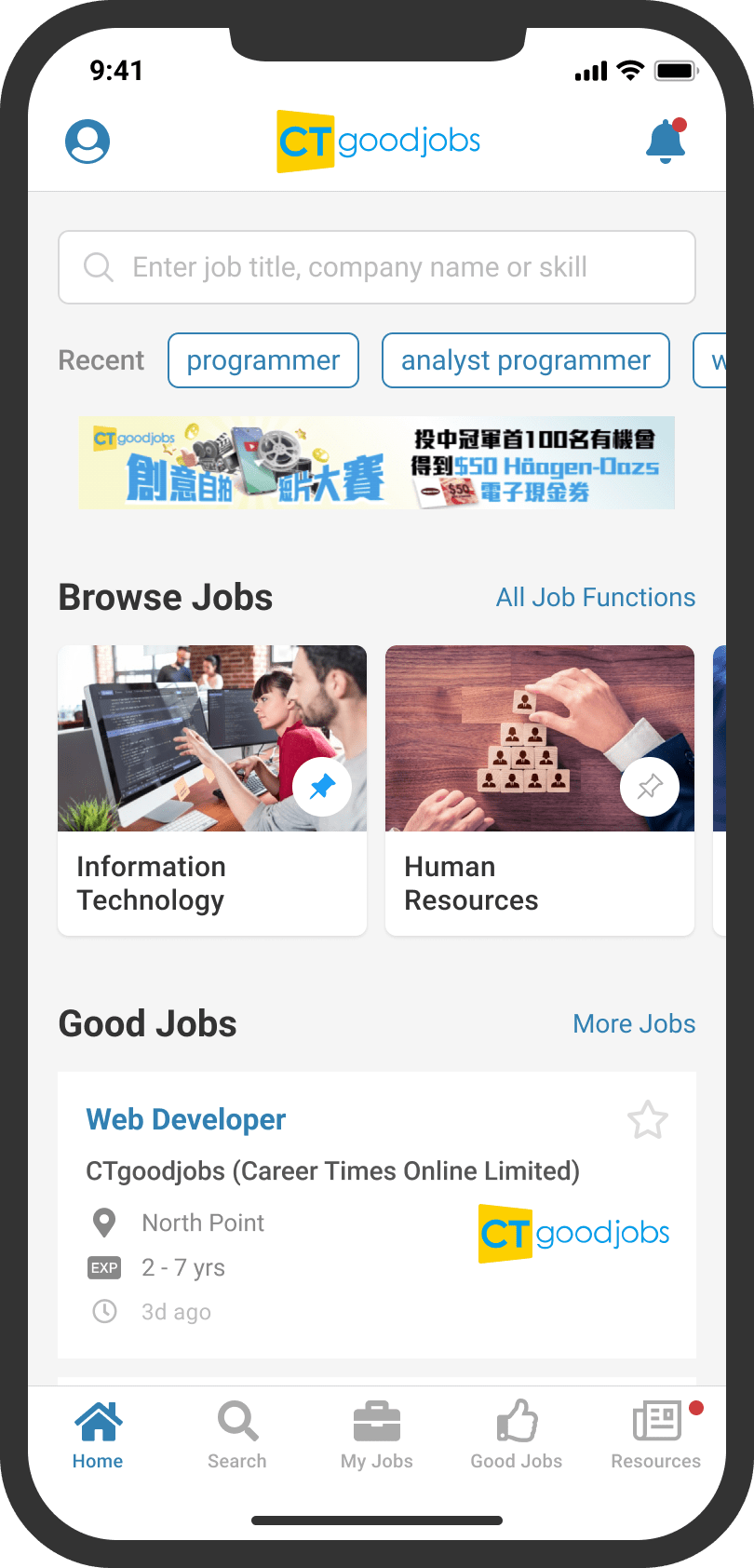

Get lastest jobs, career news and

job invitations on-the-go.

Download the CTgoodjobs app

Stay on website